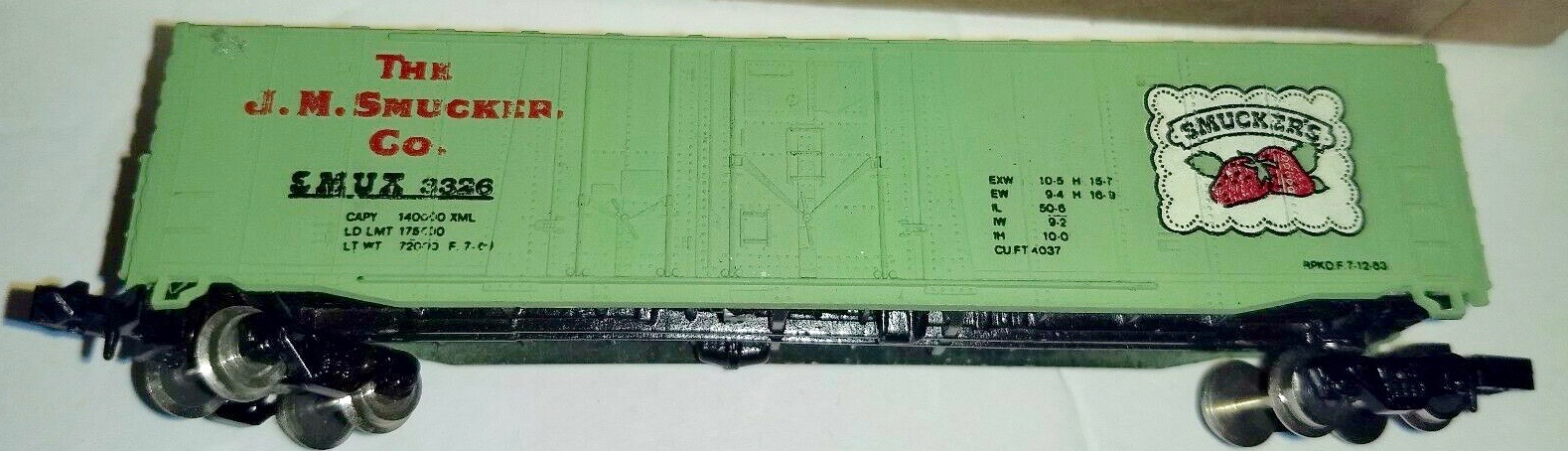

Model Information: Model Introduced: August, 2001. Era: 1970s to Present. It is a model of a DOT 111 A100 tank car.

Prototype History: Larger 50+ foot yank cars replaced their smaller predecessors in the late 1960s and 1970s. One example is the class DOT 111 A100. This car is rated for non-pressurized use with a safe maximum operating pressure of 100 psi. Developments in materials and manufacturing allowed this tanker to be constructed without an underframe. The bottom of the tank itself serves as the load bearing structure. The primary difference between the various types of DOT 111 A100 class tank cars is internal with varying types of insulation, lining and even weld material. Cars of this type haul a wide variety of commodities such as gasoline, vegetable oils, corn syrup, fruit juice and weed killers.

Road Name History: Cargill, Inc. is an American privately held global corporation based in Minnetonka, Minnesota, a Minneapolis suburb. Founded in 1865, it is now the largest privately held corporation in the United States in terms of revenue. If it were a public company, it would rank, as of 2015, number 12 on the Fortune 500, behind McKesson and ahead of AT&T.

Some of Cargill's major businesses are trading, purchasing and distributing grain and other agricultural commodities, such as palm oil; trading in energy, steel and transport; the raising of livestock and production of feed; producing food ingredients such as starch and glucose syrup, vegetable oils and fats for application in processed foods and industrial use. Cargill also operates a large financial services arm, which manages financial risks in the commodity markets for the company. In 2003, it split off a portion of its financial operations into a hedge fund called Black River Asset Management, with about $10 billion of assets and liabilities. It owned 2/3 of the shares of The Mosaic Company (sold off in 2011), one of the world's leading producers and marketers of concentrated phosphate and potash crop nutrients.

Cargill declared revenues of $136.7 billion and earnings of $2.31 billion in the 2013 fiscal year. Employing over 140,000 employees in 66 countries, it is responsible for 25% of all United States grain exports. The company also supplies about 22% of the US domestic meat market, importing more product from Argentina than any other company and is the largest poultry producer in Thailand. All of the eggs used in McDonald's restaurants in the US pass through Cargill's plants. It is the only producer of Alberger process salt in the US, which is used in the fast-food and prepared food industries.

Cargill remains a family-owned business, as the descendants of the founder (from the Cargill and MacMillan families) own over 90% of the company.[8] As a result, most of its growth has been due to reinvestment of the company's own earnings rather than public financing. Gregory R. Page, who is not part of either the Cargill or MacMillan families, is the executive chairman of Cargill. He succeeded former CEO Warren Staley in mid-2007, as Staley reached Cargill's mandatory retirement age of 65, before he in turn was succeeded by Dave MacLennan.

From Wikipedia

Some of Cargill's major businesses are trading, purchasing and distributing grain and other agricultural commodities, such as palm oil; trading in energy, steel and transport; the raising of livestock and production of feed; producing food ingredients such as starch and glucose syrup, vegetable oils and fats for application in processed foods and industrial use. Cargill also operates a large financial services arm, which manages financial risks in the commodity markets for the company. In 2003, it split off a portion of its financial operations into a hedge fund called Black River Asset Management, with about $10 billion of assets and liabilities. It owned 2/3 of the shares of The Mosaic Company (sold off in 2011), one of the world's leading producers and marketers of concentrated phosphate and potash crop nutrients.

Cargill declared revenues of $136.7 billion and earnings of $2.31 billion in the 2013 fiscal year. Employing over 140,000 employees in 66 countries, it is responsible for 25% of all United States grain exports. The company also supplies about 22% of the US domestic meat market, importing more product from Argentina than any other company and is the largest poultry producer in Thailand. All of the eggs used in McDonald's restaurants in the US pass through Cargill's plants. It is the only producer of Alberger process salt in the US, which is used in the fast-food and prepared food industries.

Cargill remains a family-owned business, as the descendants of the founder (from the Cargill and MacMillan families) own over 90% of the company.[8] As a result, most of its growth has been due to reinvestment of the company's own earnings rather than public financing. Gregory R. Page, who is not part of either the Cargill or MacMillan families, is the executive chairman of Cargill. He succeeded former CEO Warren Staley in mid-2007, as Staley reached Cargill's mandatory retirement age of 65, before he in turn was succeeded by Dave MacLennan.

From Wikipedia

Brand/Importer Information: Micro-Trains is the brand name used by both Kadee Quality Products and Micro-Trains Line. For a history of the relationship between the brand and the two companies, please consult our Micro-Trains Collector's Guide.

Manufacturer Information:  Micro-Trains Line split off from Kadee Quality Products in 1990. Kadee Quality Products originally got involved in N-Scale by producing a scaled-down version of their successful HO Magne-Matic knuckle coupler system. This coupler was superior to the ubiquitous 'Rapido' style coupler due to two primary factors: superior realistic appearance and the ability to automatically uncouple when stopped over a magnet embedded in a section of track. The success of these couplers in N-Scale quickly translated to the production of trucks, wheels and in 1972 a release of ready-to-run box cars.

Micro-Trains Line split off from Kadee Quality Products in 1990. Kadee Quality Products originally got involved in N-Scale by producing a scaled-down version of their successful HO Magne-Matic knuckle coupler system. This coupler was superior to the ubiquitous 'Rapido' style coupler due to two primary factors: superior realistic appearance and the ability to automatically uncouple when stopped over a magnet embedded in a section of track. The success of these couplers in N-Scale quickly translated to the production of trucks, wheels and in 1972 a release of ready-to-run box cars.

Micro-Trains Line Co. split off from Kadee in 1990 to form a completely independent company. For this reason, products from this company can appear with labels from both enterprises. Due to the nature of production idiosyncrasies and various random factors, the rolling stock from Micro-Trains can have all sorts of interesting variations in both their packaging as well as the products themselves. When acquiring an MTL product it is very important to understand these important production variations that can greatly enhance (or decrease) the value of your purchase.

Please consult our Micro-Trains Collector's Guide

Micro-Trains Line Co. split off from Kadee in 1990 to form a completely independent company. For this reason, products from this company can appear with labels from both enterprises. Due to the nature of production idiosyncrasies and various random factors, the rolling stock from Micro-Trains can have all sorts of interesting variations in both their packaging as well as the products themselves. When acquiring an MTL product it is very important to understand these important production variations that can greatly enhance (or decrease) the value of your purchase.

Please consult our Micro-Trains Collector's Guide

Item created by: CNW400 on 2023-11-16 10:01:02

If you see errors or missing data in this entry, please feel free to log in and edit it. Anyone with a Gmail account can log in instantly.

If you see errors or missing data in this entry, please feel free to log in and edit it. Anyone with a Gmail account can log in instantly.